An individual entrepreneur is located in a combat zone or a temporary occupation area—specifics of military tax payment.

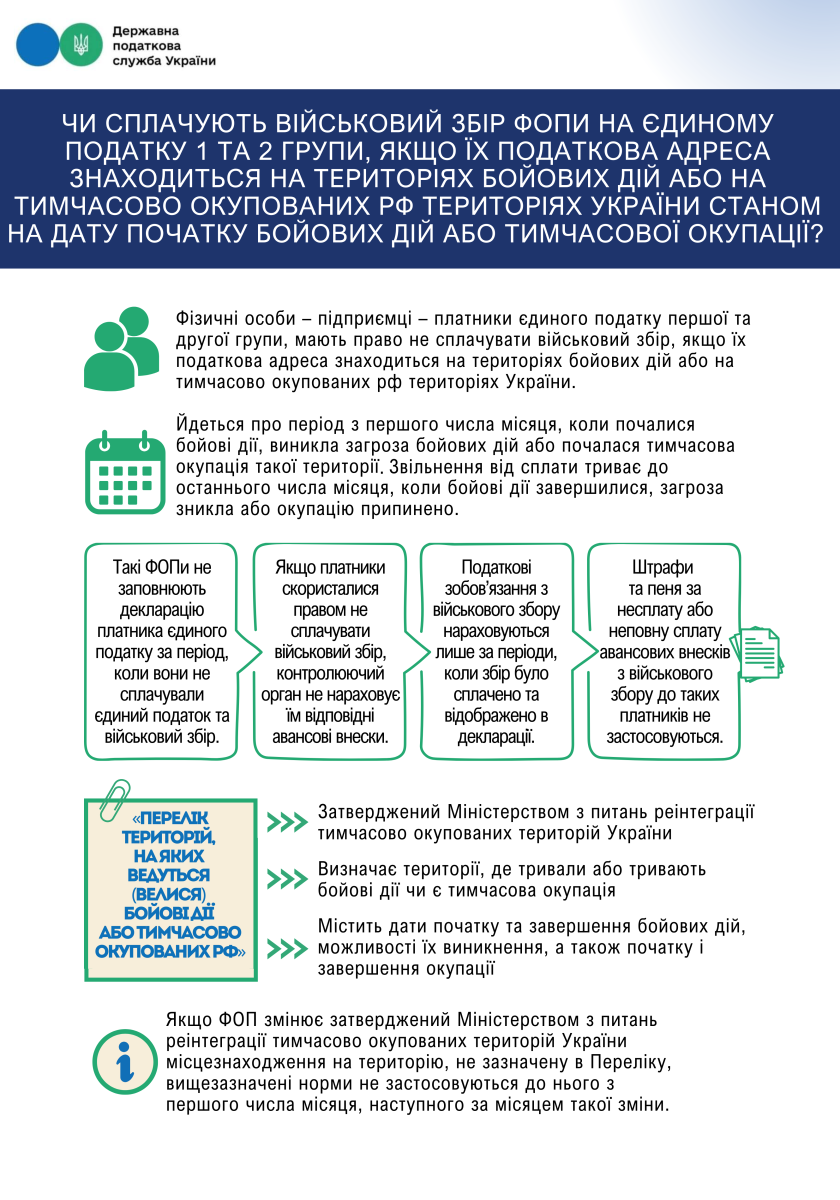

The State Tax Service has explained whether individual entrepreneurs (FOPs) in the first and second groups of the single tax are required to pay the military tax if their tax address is located in areas of active conflict or in temporarily occupied territories of Ukraine by the Russian Federation as of the date when hostilities began or the occupation started.

Individual entrepreneurs – taxpayers of the first and second groups of the single tax are entitled to refrain from paying the military tax if their tax address is situated in areas of active conflict or in temporarily occupied territories of Ukraine.

This applies to the period starting from the first day of the month when hostilities began, when there was a threat of hostilities, or when temporary occupation of such territory began. The exemption from payment continues until the last day of the month when hostilities ended, the threat disappeared, or the occupation ceased.

– Such FOPs do not fill out the single tax payer declaration for the period during which they did not pay the single tax and military tax.

– If taxpayers exercised their right not to pay the military tax, the controlling authority does not impose corresponding advance payments on them.

- Tax liabilities for the military tax are calculated only for periods when the tax was paid and reflected in the declaration.

- Penalties and interest for non-payment or incomplete payment of advance contributions for the military tax are not applied to such taxpayers.

“List of territories where hostilities are (were) conducted or temporarily occupied by the Russian Federation”:

- approved by the Ministry for Reintegration of Temporarily Occupied Territories of Ukraine;

- defines territories where hostilities continued or are ongoing or where there is temporary occupation

- includes dates of the beginning and end of hostilities, potential for their occurrence, as well as the beginning and end of the occupation.

If an FOP changes its location to a territory not listed in the aforementioned list, the above norms do not apply to them from the first day of the month following the month of such change.